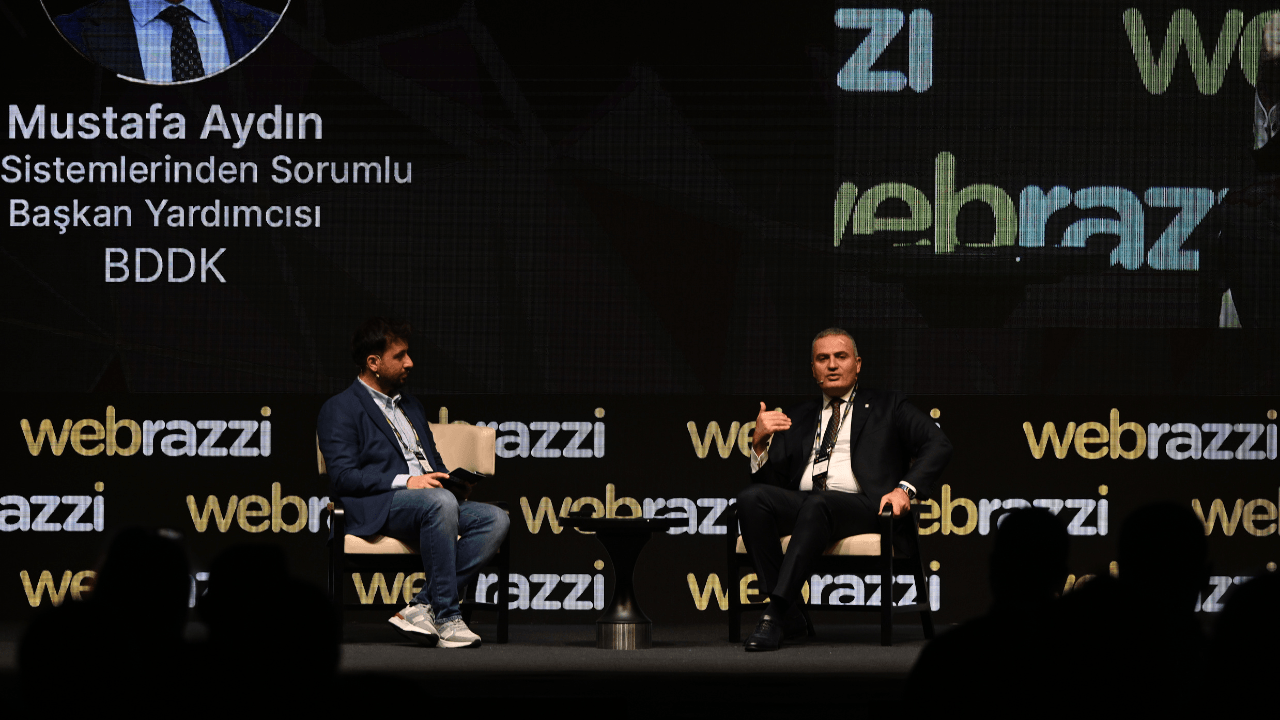

Turkey’s leading fintech conference Webrazzi Fintech 2024 It took place on December 11, 2024 at Wyndham Grand Istanbul Levent. Moderated by Webrazzi Deputy General Manager Responsible for Content Ahmet Buğra Ferahundertaken by ““Digital banking today and 2025 expectations” with the session titled Banking Regulation and Supervision Agency (BRSA) Vice President of Information Systems Mustafa Aydin Fintech was on the 2024 stage.

Reminding that they talked about the Operating Principles of Digital Banks and Service Model Banking in the sessions held every year, Ahmet Buğra Ferah said, “We can now clearly see the mobility of digital banks in the market.” Thereupon, Ferah asked: “What will we see next year? Can you evaluate the situation of digital banks? What are the issues that attract your attention?” posed the question.

Mustafa Aydın, who started his speech by reminding the steps taken by BRSA on the regulation side since 2020, stated that there are 5 digital banks that have received operating permission and 1 bank waiting for a license, focusing on digital banking. Aydın stated that this number corresponds to 20-25 percent of the banks currently engaged in retail banking.

Reminding that the institutions belonging to holding companies and the participation bank structure received licenses in this regard in the first year, he added that a regulated e-money company received a license this year. Likewise, reminding that a public bank was given an operating license for digital banking, Aydın also drew attention to the importance of the public feeling the need. Finally, he stated that an entrepreneurial structure received a license.

Expectations from digital banks

Underlining that we are at the beginning of the road with 6 digital banks, Mustafa Aydın said, “Digital banks are luckier than traditional digitalized banks.” he said. However, he also emphasized that the advantages offered by digital banks should not be similar to digitalized traditional banks. According to Mustafa Aydin; Digital banks should offer more different products and services. Aydin said, “Our expectation is that it will come up with personalized services and products.” However, he added that digital banks should not have an e-money mentality. He stated that if this were the case, the benefit expected by the public would not arise.

Mustafa Aydın stated that he thinks that there is not enough appetite for new customer acquisition for the group that has not yet become a bank customer. Stating that it is common to gain customers on another platform instead of gaining new customers, Mustafa Aydın explained that digital banks should be able to reach 85 million people in terms of service.

Ahmet Buğra Ferah reminded that when they talked about open banking two years ago, he asked what kind of collaborations there would be specifically for banks and fintechs, and said, “Today, we are witnessing really important collaborations. At the point we have reached today in service banking, we have started to see different examples.” he said. Then Ferah asked, “How would you describe today? What would you like to share about the current aspect of embedded finance and open banking?” posed the question.

While answering Ahmet Buğra Ferah’s question, Mustafa Aydın drew attention to the difference between integration and innovation. He stated that there are no problems with integration today and that these can be easily achieved through APIs. However, he stated that this situation falls short of expressing open banking. He also reminded that today, as a result of integrations with non-bank institutions in banking applications, options such as taxes, penalties, fees and bill payments can be seen. Mustafa Aydın stated that the service model banking regulation on open banking is a development that is more compatible with the definitions of partly more open banking and partly embedded finance.

Embedded finance came to life in Turkey

In addition, Mustafa Aydın, who announced that they said “yes” to an e-commerce site and bank cooperation for Turkey, stated that we are moving from open banking to open finance and a world with open data. Explaining that they are following the permission in question closely and that if it is successful, we can see new examples in 2025, Mustafa Aydın said, “Embedded finance came to life in Turkey.” He drew attention to the cooperation of banks on this issue. Among the examples he shared on this subject were fan applications and e-commerce companies.

Another highlight of this year, Crypto Asset Regulation, was also discussed during the session. Ahmet Buğra Ferah stated that banks adapted quickly and applied for licenses and asked Mustafa Aydın for his opinions on this issue.

Mustafa Aydın said, “Blockchain technology has not found the value it expected” in terms of its position in Turkey and the world. he said. Reminding the need for regulation focused on Crypto Asset Regulation, Aydın stated that BRSA is among the institutions involved in this process. It was also stated that the session targeted digital assets rather than regulating cryptocurrencies.

Aydın stated that banks’ digital asset storage will take place with the approval of both the CMB and BRSA. According to the information shared, steps regarding this issue may be taken in 2025.

He also shared global rising trends during the session. Drawing attention to the development of digital money by central banks within the scope of trends, Mustafa Aydın also emphasized the importance of developments in the field of artificial intelligence. According to the information shared in the session; He stated that the use of artificial intelligence in the field of fraud detection and call center functions is being closely examined.

Stating that Green IT is included in the work plans, Aydın added that audit and surveillance activities, which he defines as the “cold face of regulation”, will increase in 2025. In this context, it is possible to encounter a strict supervision approach in 2025.

Source link: https://webrazzi.com/2024/12/12/mustafa-aydin-dijital-bankaciligin-bugunu-ve-2025-beklentilerini-paylasti/